Is Trading Haram? A Complete Guide to Islamic Perspectives on Modern Trading in the UK

In today’s rapidly evolving financial world, Muslims across the UK and beyond are increasingly exploring avenues like stock trading, forex, and even cryptocurrency. But this raises an important and deeply religious question: Is trading haram?

The simple answer is: it depends. In Islam, trade is not inherently forbidden. However, the way one engages in trading determines whether it aligns with Islamic finance rules.

This article aims to provide a comprehensive overview of the Islamic perspective on trading, helping UK-based Muslims make informed, Shariah-compliant financial decisions.

What Does Islam Say About Trade?

Trade is not only allowed but historically encouraged in Islam. The Prophet Muhammad (PBUH) himself was a trader. The Quran declares:

“Allah has permitted trade and forbidden usury (riba).” – [Quran 2:275]

So, why then is there confusion about whether modern-day trading is halal or haram?

Islamic finance principles are based on three major prohibitions:

- Riba – interest or usury

- Gharar – excessive uncertainty or ambiguity

- Maisir – gambling or high speculation

If a trade involves any of these, it falls into the category of haram business practices. This is where the halal vs haram trading debate begins, especially in today’s financial ecosystem, where speculation, interest, and uncertainty are common.

Which Types of Trading Are Potentially Haram?

Many forms of modern trading, especially those involving speculation and high-risk financial instruments, are potentially haram. Here’s why:

Day Trading and Speculation

Day trading often involves rapid buying and selling of stocks or forex, aiming to profit from small price movements. This practice can border on gambling (maisir) as it often lacks long-term asset ownership and carries excessive risk.

Trading in Non-Halal Sectors

Buying shares in companies that deal with:

- Alcohol

- Gambling

- Pork products

- Conventional banking (involving interest)

would render the trade haram, as it supports industries prohibited by Islam.

Leverage and Margin Trading

Trading with borrowed money or on margin usually involves riba, since it accrues interest on borrowed funds. Additionally, it can introduce gharar due to its speculative nature.

When Is Trading Considered Halal?

So, is stock trading in Islam allowed? The answer is yes, provided certain Shariah-compliant investment conditions are met.

Halal Trading Conditions:

- The business is ethical and does not deal in forbidden (haram) industries.

- There is no interest (riba) involved in the transaction.

- The asset is owned before selling (no short selling).

- The trade does not involve high uncertainty or speculation.

- Contracts are transparent and based on mutual consent.

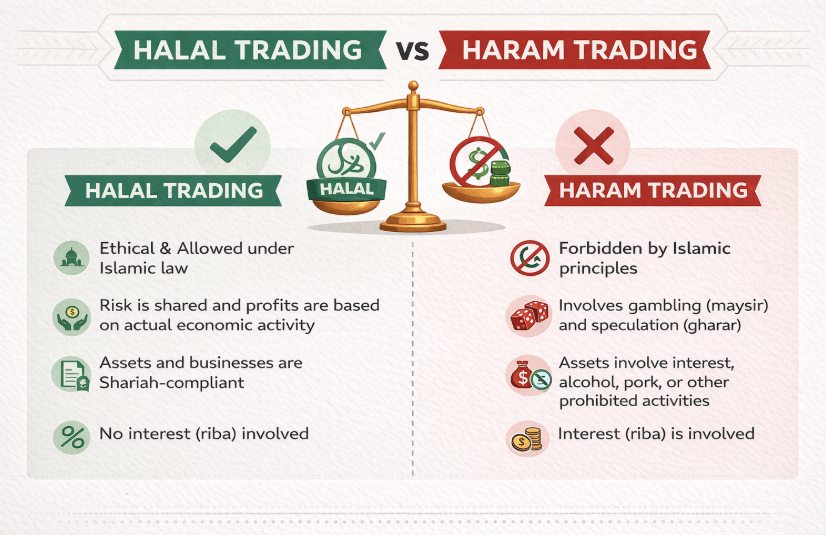

Comparison Table: Halal vs Haram Trading

| Feature | Halal Trading | Haram Trading |

|---|---|---|

| Involves interest (riba)? | No | Yes |

| Asset owned before selling? | Yes | Often not |

| Is the industry Shariah-compliant? | Ethical sectors | Alcohol, gambling, pork, etc. |

| High speculation/gambling? | Avoided | Common in derivatives, day trading |

| Transparent contract? | Fully disclosed | May lack clarity or be overly complex |

Specific Case: Forex and Online Trading for Muslims in the UK

Forex (foreign exchange) trading is popular, but it raises concerns among Muslims.

Why the Debate Around Forex?

Forex often involves:

- Trading with leverage (which incurs interest)

- Overnight positions (resulting in swap/rollover fees, often interest-based)

These factors introduce riba and gharar, making standard forex trading problematic from an Islamic standpoint.

Islamic (Swap-Free) Accounts

Some brokers now offer Islamic trading accounts for Muslims. These:

- Remove interest on overnight positions

- Avoid non-Shariah-compliant charges

- Comply with the UK’s financial regulations

Brokers for UK-Based Muslim Traders

| Broker | Type of Account | Trading Platforms | Swap-Free Option | Unique Features |

| eToro | Islamic Swap-Free Account | eToro proprietary platform | Yes (upon request) | Offers a halal-friendly version of its popular social trading system without overnight interest. |

| IC Markets | Islamic (Swap-Free) Option | MetaTrader 4, MetaTrader 5, cTrader | Yes | Interest-free on overnight positions; available on both standard and raw spread accounts. |

| Tickmill | Swap-Free Islamic Account | MetaTrader 4, MetaTrader 5 | Yes | Sharia-compliant setup with potential admin fees; same trading conditions as standard accounts. |

| AvaTrade | Halal Trading Account | MetaTrader 4, MetaTrader 5, AvaTradeGO | Yes | Fully swap-free model aligned with Islamic finance; transparent fee structure. |

| Admirals | Islamic Swap-Free Account | MetaTrader 5 (Trade.MT5) | Yes | No interest applied; enables access to forex, indices, and commodities. |

| Pepperstone | Islamic Trading Account | MetaTrader 4, MetaTrader 5, cTrader | Yes | Designed for Muslim traders; uses flat admin charges in place of interest. |

| XTB | Swap-Free Trading Option | xStation (proprietary platform) | Yes | Tailored to avoid interest and other non-permissible elements in Sharia finance. |

| Trade Nation | Islamic Swap-Free Account | Web-based and mobile platforms | Yes | Fixed-cost trading with no hidden swaps; structured for ethical investing. |

*It’s important to verify that the platform is truly Shariah-compliant and not merely offering a superficial “Islamic” label.

Practical Tips for Muslim Traders – Staying Within Islamic Guidelines

To trade ethically and within Islamic boundaries, UK Muslims should consider the following:

Checklist for Halal Trading

- Choose only Shariah-compliant stocks and sectors

- Use Islamic (swap-free) trading accounts

- Avoid margin or leveraged trading

- Don’t engage in short selling

- Ensure transparency in all contracts

- Consult with a qualified Islamic finance scholar

By following this checklist, Muslim traders can align their financial activities with their faith and still participate in modern markets.

For instance, debates over the permissibility of financial tools such as insurance are also common. One area of interest is “Is Life Insurance Haram?”, another subject that raises concerns for Muslims navigating Western financial systems.

What people generally say about trading is Haram or Halal?

Selected forum discussions

Halal day trading seems impossible, please advice!!

byu/skipSparkyPants1 inIslamicFinance

Posts from the islamicfinance

community on Reddit

Frequently Asked Questions (FAQs) About Trading is Haram or Halal?

Is day trading automatically haram?

Not always, but often. If it involves speculation and no real asset ownership, it could be considered haram. Holding assets for a longer term with clear ownership is more likely to be halal.

Can I trade derivatives or CFDs as a Muslim?

Generally, no. Derivatives and CFDs (Contracts for Difference) often involve speculation, leverage, and interest, which are not compliant with Islamic finance rules.

What about cryptocurrency trading – halal or haram?

This is debated. Some scholars allow it if:

- The crypto has utility and value

- No interest or gambling is involved

- The trading platform is Shariah-compliant

However, highly speculative crypto trading is often discouraged.

How long must I hold a trade for it to be halal?

There is no specific duration, but the focus is on:

- Actual ownership of the asset

- No reliance on short-term speculation

- Avoiding trades that resemble gambling

What if I’m using a UK broker but trading internationally?

The broker’s policies, regulatory compliance, and whether they offer Islamic accounts are all factors. Always review the terms and consult Islamic finance experts.

Conclusion

So, is trading haram? Not by default, but it can be, depending on how it’s done. Islam promotes ethical trading that avoids riba, speculation, and unethical industries.

For Muslims in the UK, the key is understanding and implementing Islamic finance principles in all trading decisions. Whether you’re trading stocks, forex, or even crypto — knowledge, discipline, and faith must guide every step.

Always consult an Islamic scholar or financial advisor familiar with both Shariah and UK regulations before investing.