Is Life Insurance Haram? A Complete Islamic View for Muslims in the UK

As financial awareness grows among Muslim communities in the UK, many are exploring ways to protect their families’ futures while staying true to Islamic values. One common question arises during this exploration: Is life insurance haram?

Life insurance is often marketed as a form of financial protection. But from an Islamic standpoint, concerns about riba (interest), gharar (uncertainty), and maysir (gambling) complicate the issue.

This blog offers a comprehensive analysis of the Islamic view on life insurance, breaks down halal vs haram distinctions, and provides UK Muslims with practical guidance, including insights from online Islamic finance communities.

What Does Islam Say About Insurance?

Islamic finance is built on a foundation of ethical contracts and the avoidance of exploitative or speculative elements. In general, insurance in Islam is scrutinised under three critical principles:

- Riba – any form of guaranteed interest

- Gharar – excessive uncertainty in contracts

- Maysir – gambling or taking advantage of chance

How do these apply to insurance?

In conventional life insurance:

- You pay a premium and receive a lump sum payout on death or after a period.

- But the outcome is uncertain: you may get nothing, or a large amount.

- The company may invest your premium in interest-bearing (riba-based) instruments.

- The structure can resemble a wager — you pay in, not knowing if or how much you’ll benefit.

Because of these features, many Islamic scholars consider conventional life insurance haram.

️ “Insurance contracts contain excessive uncertainty and resemble gambling. Riba is often involved. Therefore, most forms are haram.” — IslamQA Fatwa No. 10805

What Types of Life Insurance Are There?

To fully understand the Islamic ruling, it’s important to recognise the different types of life insurance available:

Term Life Insurance

- Provides coverage for a specific term (e.g. 10, 20, 30 years)

- Pays out if the policyholder dies during the term

- Usually no cash value if the term ends without a claim

- Considered more acceptable by scholars as it is protective, not investment-based

Whole Life (or Permanent) Insurance

- Covers the policyholder for life

- Includes a cash value component (invested, often with interest)

- Seen as problematic in Islam due to investment in riba and uncertainty

As noted by IslamicFinanceGuru: “Whole life insurance is generally haram due to its structure. Term policies may be acceptable if they are not investment-based and free from uncertainty.”

Why Conventional Life Insurance May Be Considered Haram

Most scholars agree that conventional life insurance includes several haram elements, including:

Riba (Interest)

Many insurers invest your premiums in interest-bearing instruments, such as bonds or savings accounts. This constitutes riba, which is strictly forbidden in Islam.

Gharar (Uncertainty)

The insurance contract has uncertain outcomes — you may pay for years and never receive anything in return, or receive a large payout, based on an unknown event (your death). This excessive uncertainty is gharar, which invalidates contracts in Islamic law.

Maysir (Gambling)

The payout from a life insurance policy can resemble a bet on whether the policyholder lives or dies during the policy term. This is likened to maysir, or gambling, which is also haram.

Conventional life insurance policies, especially those with investment or cash-value elements, typically violate one or more Islamic finance rules, making them non-compliant with Shariah.

When Might Life Insurance Be Considered Halal?

Some scholars and Islamic finance experts suggest that not all life insurance is haram, and in certain cases, it may be halal if it meets the following criteria:

Conditions for Permissible Life Insurance

- The policy is term-only, without any cash value or investment.

- The contract terms are clear and transparent, avoiding ambiguity.

- There’s no riba involved in the insurer’s investment strategy.

- The intent is protection for dependents, not profit.

In these cases, life insurance is viewed more as a mutual protection agreement, which can be aligned with Islamic contract principles.

What Is Takaful? A Shariah-Compliant Alternative

To resolve the issues with conventional insurance, Islamic scholars developed Takaful — a Shariah-compliant cooperative insurance model.

In Takaful:

- Participants contribute into a shared pool.

- The pool is used to help members in case of death or loss.

- Funds are managed without interest or unethical investments.

- Risk is shared, not transferred to a company for profit.

Takaful is widely accepted by Islamic scholars as halal and increasingly available in global markets — though UK options are currently limited.

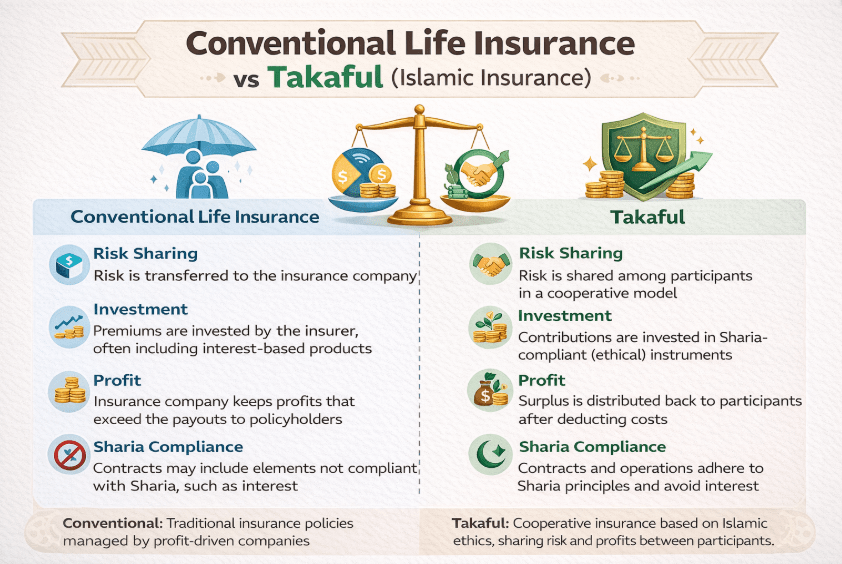

Conventional Life Insurance vs Takaful

| Feature | Conventional Life Insurance | Takaful (Islamic Insurance) |

|---|---|---|

| Risk Transfer or Sharing? | Risk transferred to insurer | Risk is mutually shared by participants |

| Use of Interest (Riba)? | Often used in investment funds | Prohibited, investments must be halal |

| Profit Model | Insurer profits from unused premiums | No profit motive, surplus shared |

| Shariah Oversight | None | Governed by the Shariah advisory board |

| Ethical Screening? | Not guaranteed | Yes, only halal industries are allowed |

What UK Muslims Should Consider?

Life insurance isn’t a one-size-fits-all solution, especially in Islamic finance. Muslims in the UK should carefully evaluate their options.

Practical Checklist for UK Muslim Consumers:

- Is the policy term-only? (Avoid whole life or investment-linked policies)

- Does the provider offer a Shariah board or Islamic certification?

- How are the premiums invested? (Ask for full transparency)

- Can you consider Takaful? (Even if offered outside the UK)

- Would a will or trust better meet your protection goals?

Some UK providers offer ethical investment products but may not label them “Islamic.” As of now, Takaful options are limited in the UK, but you can explore global Takaful companies that serve UK residents.

Community Discussion & Real‑World Views

Discussions on platforms like Reddit and Quora reflect the uncertainty many Muslims feel about life insurance.

️Another user says: “It’s really hard to find proper Islamic life insurance in the UK. I just set up a term life plan with a clean structure until Takaful becomes more available.”

These community insights show that while many Muslims are aware of the haram elements in insurance, they are also actively seeking ethical insurance alternatives that align with faith.

Conclusion

So, is life insurance haram? In most conventional forms, especially those involving interest, investment, and uncertainty, yes, it is considered haram by the majority of scholars.

However, not all insurance is the same. Term-based life insurance with no investment component may be considered halal under certain conditions. Even better, Takaful offers a fully Shariah-compliant model based on mutual cooperation and ethical investing.

Always scrutinise the structure of the policy. When in doubt, consult a trusted Islamic scholar or financial adviser with expertise in Islamic finance rules.

For those also curious about other financial matters, the topic of whether trading is halal or haram is explored in depth in this guide on Is Trading Haram, providing further clarity on modern financial practices through an Islamic lens.