UK State Pension Age Retirement Changes: What’s Changing and Why It Matters

If you’ve been searching for UK state pension age retirement changes, you’re not alone. The headlines can make it sound like the goalposts are moving constantly, but most of what matters comes down to: what’s already set in law, what’s currently under review, and what your date of birth means in practice.

Let’s explore what’s changing, what isn’t, and how you can plan with confidence, whether you’re employed, self-employed, or running a small business.

UK State Pension Age Retirement Changes: What’s Changing and Why It Matters

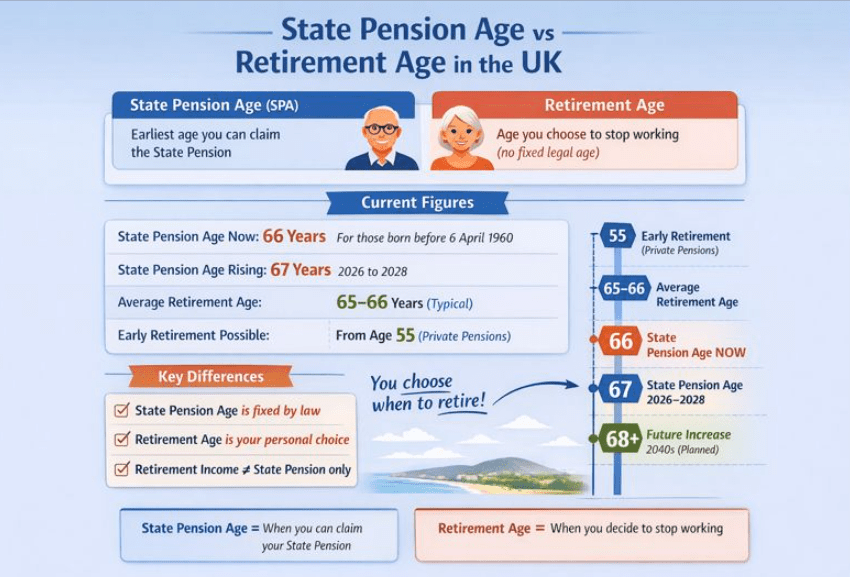

What’s the difference between State Pension age and retirement age in the UK?

A lot of confusion comes from mixing up two different ideas:

- State Pension age (SPA) is the earliest age you can claim the State Pension from the government.

- Retirement age is the age you choose to stop working (or reduce work), which might be earlier or later than your SPA.

Can you retire before State Pension age and claim later?

Yes. You can stop working before your SPA, but you’ll need a plan to bridge the income gap until your State Pension starts (for example, workplace/personal pension, ISA savings, part-time work, or a partner’s income).

What is the UK State Pension age right now?

Right now, the State Pension age is 66 for men and women. The important bit: it’s scheduled to rise, and the next change affects specific birth dates.

How do you check your exact State Pension age?

Use the official State Pension age checker and your State Pension forecast on GOV.UK (search those exact terms). You’ll get your personal date and a forecast of what you might receive.

When are the State Pension age changes happening from 66 to 67?

The increase from 66 to 67 is scheduled to be phased between 2026 and 2028. This primarily affects people born between 6 April 1960 and 5 March 1961, who reach SPA at 66 plus a number of months (depending on date of birth). After that, SPA becomes 67 for later cohorts.

At-a-glance: what’s set in law vs what’s being reviewed

| Topic | What’s currently set | What to watch |

| Current SPA | 66 | — |

| SPA rising to 67 | Phased between 2026–2028 | Your exact month depends on your DOB |

| SPA rising to 68 | Scheduled between 2044–2046 | Could change after reviews, but would require legislation |

| State Pension age reviews | Reviews happen periodically | New evidence can influence future recommendations |

Who is affected by the 66 → 67 phase-in?

Here’s a simplified snapshot of what “66 plus months” can look like. (Your exact date still depends on your full DOB.)

| Date of birth (examples) | State Pension age reached |

| 6 Apr 1960 – 5 May 1960 | 66 years + 1 month |

| 6 Jul 1960 – 5 Aug 1960 | 66 years + 4 months |

| 6 Dec 1960 – 5 Jan 1961 | 66 years + 9 months |

| 6 Feb 1961 – 5 Mar 1961 | 66 years + 11 months |

| 6 Mar 1961 – 5 Apr 1977 | 67 |

Will the UK State Pension age rise to 68, and could it happen earlier?

Under current law, the timetable schedules SPA rising from 67 to 68 between 2044 and 2046.

What makes people nervous is that reviews can recommend changes. That doesn’t mean your SPA changes overnight; it means future governments could legislate changes based on updated life expectancy and affordability evidence.

If you want a practical takeaway: treat UK state pension age retirement changes as a “plan for what’s confirmed, monitor what’s being reviewed” topic, especially if you’re building a long-term retirement timeline.

How do State Pension age changes affect women (including the WASPI issue)?

Many readers encounter two overlapping topics:

- The law changes to equalise and increase SPA over time

- The debate about how those changes were communicated, particularly to women born in the 1950s

If this is relevant to you, focus on your personal SPA date first (official checker), then look at the official outcomes and guidance around the communication issue, rather than relying on second-hand summaries.

How do these UK retirement age changes affect small businesses and the self-employed?

These UK state pension age retirement changes don’t just affect individuals; they shape workforce planning and retirement conversations at work.

For small business owners and the self-employed, keeping track of evolving pension frameworks is essential.

That includes staying aware of upcoming regulatory updates, such as the new DWP Pension New Bank Rules, which are set to come into force from September 2025 and may influence how pension payments are processed and verified through banking systems.

If you employ people, how can you plan without drama?

- Offer phased retirement options (reduced hours, flexible schedules, mentoring handovers).

- Build knowledge transfer into project planning (so exits aren’t cliff edges).

- Support wellbeing and adjustments where needed (role design matters more than assumptions).

- Train managers to keep conversations role-based and age-inclusive.

If you’re self-employed or a company director: what matters most?

Your State Pension amount depends mainly on your National Insurance (NI) record (qualifying years).

Many people need around 10 qualifying years to get anything and around 35 qualifying years for the full new State Pension, but contracted-out history can change outcomes, so your forecast is the best source for your situation.

What can you do next? A practical retirement planning checklist

- Check your SPA date using the official GOV.UK checker (search: “State Pension age checker”).

- Check your State Pension forecast and your NI record (search: “State Pension forecast”).

- Map your “bridge” if you’re caught in the 2026–2028 phase-in (cash buffer, pension timing, part-time work).

- Be scam-aware: treat unsolicited pension “help” messages and pressure tactics as red flags.

How users talk about this on Reddit, Facebook, and X

When the state pension age may have to rise to 68, according to experts

byu/theipaper inukpolitics

State pension age could hit 80 unless major changes made, expert warns

byu/PrestigiousBrit inunitedkingdom

From 6 April 2026, the State Pension age is increasing from 66 to 67.

If you’re aged 65 or 66, it is important to check when you will be able to claim your State Pension via the State Pension age calculator

Share today📢

Make sure you’re in the know:https://t.co/34QlKeapbX pic.twitter.com/lUXc1B2V1R

— Independent Age (@IndependentAge) June 12, 2025

It’s going up to 67 2026-28. Next legislated increase not til 2044. Should be sooner, though people deserve a decade’s notice. Hope review suggests, and govt accepts, increase to 68 in late 2030s. Also need more support for those on low incomes just below pension age. https://t.co/kVZWUgSew3

— Paul Johnson (@PJTheEconomist) July 21, 2025

Final summary

Here’s the simple way to think about it: SPA is 66 now. The move to 67 is scheduled and phased between 2026–2028.

The move to 68 is scheduled between 2044–2046, but future reviews can influence whether the timetable changes (via legislation).

Here’s what you can do next: Check your exact SPA date and forecast, then build a “bridge plan” if you’re in the transition band. That turns uncertainty into a clear, workable timeline.

FAQs

When is the State Pension age increasing to 67?

The rise from 66 to 67 is scheduled to be phased between 2026 and 2028, depending on your date of birth.

Is the State Pension age going up to 68?

Current legislation schedules the move from 67 to 68 between 2044 and 2046. Whether that timing changes depends on future reviews and legislation.

How many NI years do I need for a full UK State Pension?

Many people under the new State Pension system need around 35 qualifying years for the full amount and around 10 years to receive anything, but your forecast is the most reliable way to see your personal position.

Can I retire at 60/62/65 and claim the State Pension later?

Yes. You can retire earlier, but you can’t claim the State Pension until you reach your State Pension age.

Author expertise note: This guide is written for a practical UK audience (including SME owners and managers) and focuses on the real-world decisions people make around work, NI records, and bridging income gaps, so you can plan calmly and avoid misinformation.