Limited Capability for Work Payments: 2026 Rates & Rules

2026 Reform Alert: As of the Universal Credit Act 2025, the “Health Element” (LCWRA) is undergoing a major rebalance. If you are found to have LCWRA before 6 April 2026, your payment is protected at the higher rate. New claimants after this date may receive a significantly lower “Health Element” of approximately £217.26 per month.

The landscape of disability support in the UK is undergoing its most significant transformation in a decade. As of January 2026, the Department for Work and Pensions (DWP) has begun implementing the “Universal Credit Rebalance,” a policy shift that fundamentally changes how limited capability for work payments are calculated.

If you are navigating a health condition or disability, understanding these changes is no longer just about knowing “the rate”—it is about understanding where you fit in a two-tiered system. This guide breaks down exactly what you can expect from your payments this year, how the April 2026 “cliff edge” affects you, and the steps you must take to protect your income.

What are Limited Capability for Work (LCW) payments?

When you report a health condition to Universal Credit, you undergo a Work Capability Assessment (WCA). Based on this, the DWP places you into one of three categories.

It is a common misconception that “Limited Capability for Work” (LCW) always comes with an extra payment. In reality, the system is split:

- Fit for Work: No extra health-related payments; full work-search requirements.

- Limited Capability for Work (LCW): You aren’t expected to work now, but you must prepare for work (e.g., CV workshops). New LCW claimants generally receive £0 extra per month, though they do benefit from a “Work Allowance.”

- Limited Capability for Work and Work-Related Activity (LCWRA): You are not expected to work or prepare for work. This is the only group that receives a substantial additional monthly payment, now officially referred to in 2026 policy documents as the “Health Element.”

How much are limited capability for work payments in 2026?

The 2026/27 tax year introduces a split rate. To “rebalance” the system, the government has increased the Standard Allowance for everyone while significantly reducing the health-related top-up for new claimants.

Universal Credit Health Rates (Monthly)

| Claimant Category | 2025/26 Rate | 2026/27 Rate (From April) | Status |

| Standard Allowance (Single 25+) | £400.14 | £424.90 | Increased for all |

| LCWRA / Health Element (Protected) | £423.27 | £429.08 | Existing/Severe claims |

| LCWRA / Health Element (New) | £423.27 | £217.26 | Claims after 6 April 2026 |

| LCW Element | £0.00 | £0.00 | No change |

Critical Note: If your LCWRA entitlement began before 6 April 2026, you are classified as a “Pre-2026 Claimant.” You will receive Transitional Protection, ensuring your payment remains at the higher rate (£429.08) rather than dropping to the new lower rate.

Who qualifies for the higher “Protected Rate” after April 2026?

The DWP has established a “two-tier” system. While the new lower rate of £217.26 is the default for new applications, three specific groups are legally entitled to the higher £429.08 rate:

- Pre-2026 Claimants: Anyone whose LCWRA status was awarded and active before 6 April 2026.

- Severe Conditions Criteria: A new “fast-track” for 2026. If a healthcare professional confirms your condition is lifelong, severe, and you are “never expected to work,” you bypass the lower rate.

- Terminal Illness (SREL): Under the “12-month rule,” those with a terminal diagnosis automatically receive the highest rate of support from Day 1 of their claim.

The “5th January” Deadline

Because of the mandatory three-month relevant period (waiting period), users who did not submit their first “Fit Note” by 5 January 2026 will likely find their first payment falling after the April 6th cutoff. If you are applying now, you must ensure your medical evidence is robust to argue for the “Severe Conditions” criteria to avoid the lower payment tier.

Who is protected from the 2026 LCWRA payment cuts?

Not everyone will see a reduction. You are eligible for the Protected Higher Rate (£429.08) if:

- Existing Claimants: You were already receiving the LCWRA element before 6 April 2026.

- Severe Conditions Criteria (SCC): You have a lifelong, progressive, or terminal condition that meets the DWP’s new “Severe” descriptors.

- Terminal Illness: Claimants under the “Special Rules for End of Life” are automatically fast-tracked to the higher rate.

How to Prove “Severe Conditions” to Secure the Higher Payment Rate?

To secure the higher limited capability for work payment (£429.08) as a new claimant after April 2026, you must meet the Severe Conditions Criteria (SCC).

This is a higher bar than the standard LCWRA assessment. While standard LCWRA requires you to show you cannot work at the moment, the SCC requires you to prove that your condition is lifelong, irreversible, and constant.

Use this checklist to ensure your medical evidence speaks the specific language the DWP is looking for in 2026.

1. The “Irreversibility” Requirement

The DWP’s main goal with SCC is to identify people who will never be expected to work again. Your evidence must explicitly state:

- The condition is permanent or progressive (getting worse over time).

- There is no realistic prospect of improvement or recovery, even with further treatment.

- All primary treatment options have been exhausted, or further treatment is only for “palliative” or “maintenance” purposes rather than a cure.

2. The “Constancy” Rule (New for 2026)

One of the biggest traps in the 2026 rules is the requirement to meet descriptors “constantly.”

- Evidence must state that you meet at least one LCWRA descriptor at all times (or every time you attempt the activity).

- Avoid the “Fluctuating” Trap: If your doctor says your condition “varies,” the DWP may reject the SCC and put you on the lower £217.26 rate. Your evidence should focus on your baseline level of severe impairment that never clears.

3. Key Medical Evidence Checklist

Do not rely on a simple prescription list. You need “Functional Evidence”:

- Secondary Care Letter: A letter from a Specialist/Consultant (Oncology, Psychiatry, Rheumatology, etc.) carries more weight than a GP note.

- Diagnostic Confirmation: Clear evidence of a diagnosed NHS condition (e.g., Advanced Dementia, Treatment-Resistant Schizophrenia, Grade 4 Heart Failure).

- Social Care Records: If you have a social worker or a “Care Plan” from the local council, this is powerful proof that you require 12–24 hour supervision or assistance with daily living.

- Hospital Summaries: Recent discharge papers that highlight the severity of relapses or the intensive nature of ongoing “Maintenance” treatment.

4. Specific “Automatic” SCC Categories

If you fall into these groups, ensure your medical professional uses these specific terms:

- Terminal Illness: Presence of an SR1 form (12-month rule).

- Severe Cognitive Impairment: Requires 12-24 hour supervision to stay safe or complete “Activities of Daily Living” (ADLs).

- Total Sensory Loss: Certification as Severely Sight Impaired combined with significant hearing loss (Deafblind).

- Substantial Risk (Regulation 35): Evidence that work-related activity would cause a substantial risk to your life or the health of others (often used for severe mental health crises).

How does the Work Capability Assessment (WCA) work in 2026?

The assessment remains the “gateway” to these payments. It usually involves filling out a UC50 form and attending a medical assessment (now increasingly conducted via video call or at a regional hub).

To qualify for limited capability for work payments (LCWRA), you must score 15 points in one of the physical or mental health descriptors, or meet one of the “descriptors” that signify a total inability to work.

Automatic Qualification (The “Treat As” Rules)

You may not need a full assessment if you:

- Are receiving weekly chemotherapy or radiotherapy.

- Are at “Substantial Risk” (Regulation 35). This is vital for mental health claimants: if being found “fit for work” would cause a serious risk to your health or the health of others, you must be placed in the LCWRA group.

Can you work while receiving limited capability for work payments?

One of the most positive changes in the Universal Credit Act 2025 is the “Right to Try Guarantee.” Previously, many claimants feared that taking a part-time job would trigger a “reassessment” and lead to them losing their health payments. In 2026, the rules have been relaxed:

- The Guarantee: You can take a job to “test your strength” without an immediate reassessment of your LCWRA status.

- The Work Allowance: You can earn a certain amount before your Universal Credit is reduced. For 2026/27, if you get housing support, your allowance is roughly £416; if you don’t, it’s roughly £690. For every £1 you earn above this, your UC is reduced by 55p.

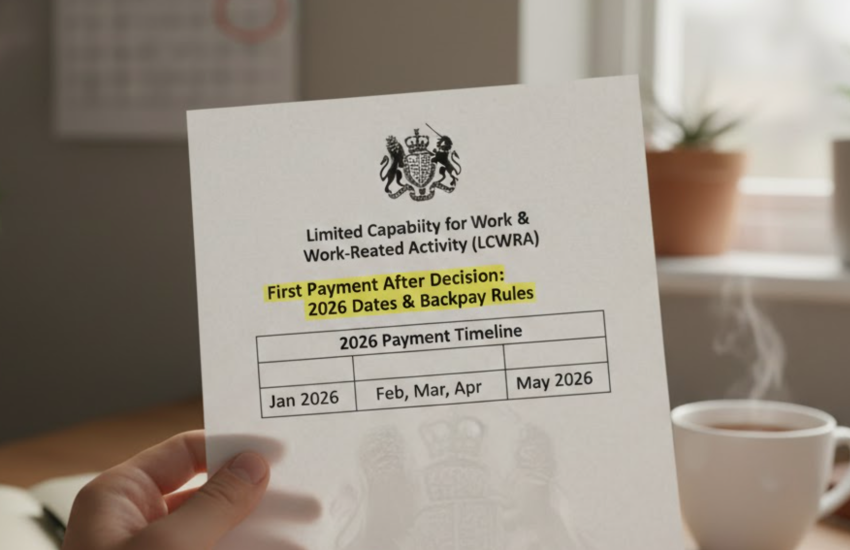

How are LCWRA payments backdated?

If the DWP takes six months to decide your claim (which is common), you are entitled to backpay—but only after the “Relevant Period.”

- Month 1–3: The waiting period. No health element is paid.

- Month 4 onwards: The health element should be added.

- The Arrears: If your award is granted in Month 7, you should receive a lump sum covering the LCWRA element for Months 4, 5, and 6.

Pro Tip: Check your “Journal” for the date you provided your first Fit Note. This date is the “anchor” for your backpay. If there are gaps in your Fit Notes, the DWP may try to restart your three-month waiting period.

FAQ about “Limited Capability for Work Payments”

Can I get LCWRA and PIP at the same time?

Yes. Personal Independence Payment (PIP) is for the extra costs of living with a disability, while LCWRA is for your inability to work. They are separate. However, be aware that following the 2025 Timms Review, the DWP is looking to align the criteria more closely in the coming years.

Do I need to keep sending Fit Notes after I’m awarded LCWRA?

No. Once the DWP officially awards you the LCWRA element, you usually no longer need to provide monthly Fit Notes unless your condition changes or you are undergoing a scheduled review.

What happens if I move from ESA to Universal Credit in 2026?

If you are moved via “Managed Migration,” your LCWRA status should carry over. This is known as Transitional Protection. You should not have to undergo a new assessment immediately, and your payment rate should be “eroded” slowly rather than cut instantly.

Why is my LCWRA payment lower than my friend’s?

If your claim started after 6 April 2026, you are likely on the new rate of £217.26. Your friend, who claimed in 2025, is protected at the higher rate of £429.08.

Summary & What to do Next

The 2026 changes to limited capability for work payments have created a complex, tiered system. While the Standard Allowance has increased to help with the cost of living, the “Health Element” is now harder to access at the higher rate.

Your Action Plan:

- Check your ‘Relevant Period’: If you applied recently, check your journal to see if your entitlement started before April 6th.

- Gather Evidence for ‘Severe Conditions’: If you are a new claimant, a simple doctor’s note may not be enough. You need evidence that your condition is permanent to qualify for the higher £429.08 rate.

- Utilize the Work Allowance: If you feel able to work a few hours, remember the 2026 “Right to Try” rules protect you from losing your status immediately.

Navigating the DWP can be exhausting, especially when you are unwell. If you believe your assessment has been handled incorrectly, you have one month from the date of the decision to request a Mandatory Reconsideration.

If an employee is moving to LCWRA, ensure they understand the 2026 cutoff so they aren’t surprised by the ‘Health Element’ reduction.