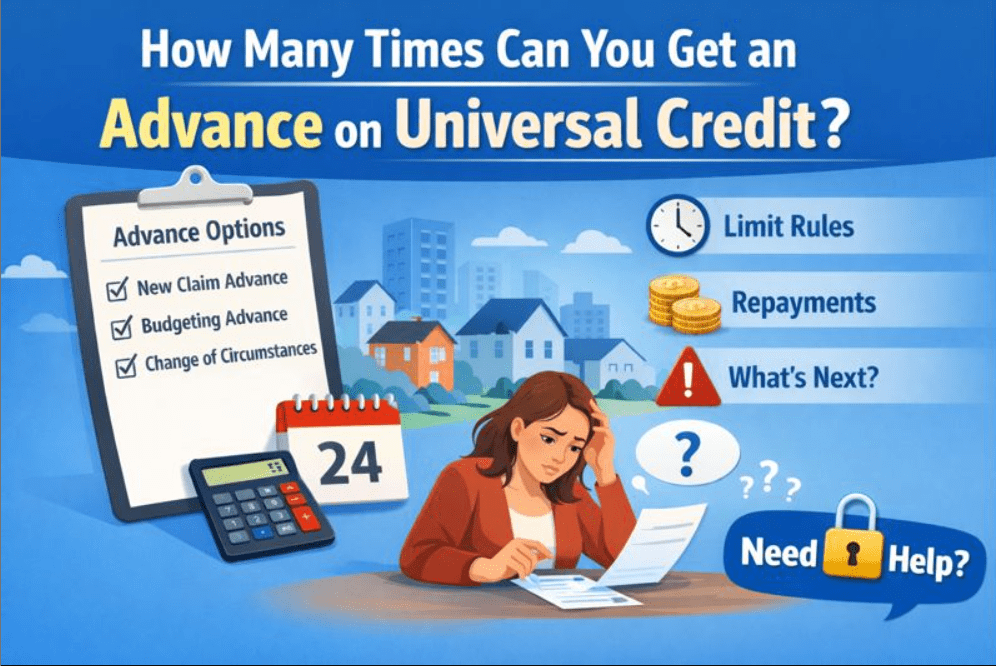

How Many Times Can You Get an Advance on Universal Credit? Rules, Limits & What to Do Next

If you’re searching how many times can you get an advance on universal credit, you’re not alone, but the answer depends on which advance you mean. Universal Credit has different advance types, and each one has different repeat rules.

Let’s explore what you can actually request, what “again” really means, and what you can do next if you’re short this month.

How many times can you get an advance on Universal Credit? The direct answer

You can’t keep getting the same advance repeatedly just because you paid it back. Instead:

- New claim advance (advance on your first payment): Generally, one per new claim, but you may be able to request an additional amount shortly after if you didn’t take the full month up front.

- Budgeting Advance (for one-off or unexpected costs while on UC): You can get it more than once over time, but usually only if you’re not still repaying a previous Budgeting Advance and you meet eligibility checks.

- Change of circumstances advance: Possible when a reported change increases your Universal Credit, and you haven’t yet been paid the higher amount.

Quick overview by advance type

| Advance type | Can you get it more than once? | Practical limit |

|---|---|---|

| First payment (new claim) advance | Sometimes, within the same claim | Total can’t exceed your estimated first monthly UC amount |

| Budgeting Advance | Yes, over time | Usually, only one outstanding at a time |

| Change of circumstances advance | Yes, if eligible | Must be requested before the higher payment is made |

New Claim Advance: How many times can you get advance on Universal Credit?

A new claim advance is designed to help you cover costs during the five-week wait for your first Universal Credit payment.

Can you get a second first-payment advance?

In practice, you usually won’t get repeated new-claim advances. However, if you asked for less than your full monthly entitlement at first, you may be able to request an additional amount shortly after, provided the total stays within your monthly award.

How long do you repay it for?

Most advances are repaid through deductions from your Universal Credit, usually over up to 24 months, starting from your first payment. In some cases, you can request a short repayment delay if deductions would cause hardship.

Budgeting Advance: Can you get advance on Universal Credit more than once?

This is where most people asking how many times can you get an advance on Universal Credit really need clarity.

A Budgeting Advance is an interest-free loan intended for essential one-off costs such as replacing household appliances, moving home, or work-related expenses.

The rule that decides everything

You usually cannot get another Budgeting Advance if you’re still repaying a previous one (including where you’re on a joint claim).

That means, you can get a Budgeting Advance multiple times over your time on Universal Credit, but typically only one at a time

Common eligibility reasons repeat requests are refused

- You’re still repaying an earlier Budgeting Advance.

- Your earnings over the last six months are too high.

- Your savings exceed the limit.

- Deductions would make repayment unaffordable.

How much can you get?

| Household type | Maximum Budgeting Advance |

|---|---|

| Single | £348 |

| Couple | £464 |

| With children | £812 |

The actual amount offered may be lower depending on affordability and existing deductions.

Repayments and recent changes

Budgeting Advances are now usually repaid over up to 24 months, rather than shorter periods in the past.

In addition, most Universal Credit debt deductions are now capped at 15% of the standard allowance, which can make repayments more manageable for many households.

Change of circumstances advance: How many times can you request an advance on Universal Credit?

You may be able to request an advance if a reported change will increase your Universal Credit, such as:

- Adding housing costs.

- A new child element.

- Another change that raises your award.

The key rule: you must request the advance before you receive the higher payment. Once the increased amount has been paid, an advance for that change is no longer available.

Why your advance might be refused and what to do next?

Even if you haven’t had an advance recently, refusals are common.

Common reasons for refusal

- You’re considered able to manage until your next payment.

- You’re already repaying a Budgeting Advance.

- Your income or savings are too high.

- Existing deductions make repayment unaffordable.

What you can do next?

- Check whether you’re eligible for a different type of advance.

- Ask whether you can increase a first-payment advance if you initially took less.

- Explore other support options if an advance isn’t available.

Practical “What to do next?” checklist

Before requesting an advance:

- Work out exactly how much you need and what it’s for.

- Check what deductions already come off your Universal Credit.

- Borrow the smallest amount that solves the problem.

- Consider whether repayments will clash with a low-income month.

Warning for Self-employed and SME owners

If you’re self-employed or running a small business, Universal Credit is still assessed on a monthly basis, which can make advances tempting during a quieter trading period.

This can be particularly challenging for people operating as smaller businesses, where income often fluctuates. Understanding what is an SME can help clarify how your business structure fits into this picture.

While an advance may ease short-term cash flow, repayments reduce future Universal Credit payments, which can add pressure during low-income months. For that reason, it’s usually safer to borrow cautiously and factor repayments into both your household and business budget before applying.

How people talk about this online?

Can you get a new UC budgeting advance after paying one off early?

byu/Zealousideal_Ear8991 inDWPhelp

People on Universal Credit who take out a Budgeting Advance loan of up to £812 to pay for an unexpected emergency will have 24 months to repay the amount instead of 12 https://t.co/49osvJCSll

— The Daily Record (@Daily_Record) March 8, 2024

Final summary

If you’re asking how many times can you get an advance on Universal Credit, the short answer is: it depends on the type of advance.

- A first-payment advance is tied to the start of a claim.

- A Budgeting Advance can be taken multiple times over the long term, but usually only one at a time.

- Advances linked to changes in circumstances depend on timing.

Here’s what you can do next: identify which advance applies to your situation, borrow only what you need, and factor the repayments into your future Universal Credit budget before applying.

FAQ

Can you apply for a Universal Credit advance again?

Yes, depending on the type. Budgeting Advances can be taken again over time if you’re eligible and not still repaying one.

How soon can you get another advance?

There’s no fixed waiting period. It depends on eligibility, affordability, and whether you still owe money on a previous advance.

Can you get a Budgeting Advance while repaying another?

Usually no.

Can you reduce advance repayments?

You can ask for help if repayments cause hardship, including requesting a short delay in some cases.

What’s the difference between a hardship payment and an advance?

An advance is money you repay from future Universal Credit. A hardship payment applies in specific situations where payments are reduced or stopped.

Author expertise note

This guide is written using a plain-English approach commonly used in UK money, benefits, and small-business guidance, designed to help readers understand Universal Credit rules without legal jargon or unnecessary complexity.