Nationwide Customers to Get £50 Bonus Payment in April: Who Qualifies, When It’s Paid, and What to Do Next (UK)

If you’ve seen the phrase Nationwide customers to get 50 bonus payment in April, you’re not alone. It spread fast because it sounds like a generic bank promo, but in this case, it referred to a specific Nationwide Building Society scheme called The Big Nationwide Thank You (a one-off £50 payment to eligible members).

If you were eligible, Nationwide aimed to pay you by the end of April 2025 (usually directly into an account, otherwise by cheque).

You’ll also see it written as nationwide customers to get 50 bonus payment in April in community posts, and sometimes as nationwide customers to get 50 bonus payment in April in headlines, but it all comes down to the eligibility rules and payment methods below. Let’s explore what it meant for you.

Nationwide customers to get 50 bonus payment in April: what it actually means?

Is Nationwide really giving customers £50?

Yes, this was a real Nationwide member payment under The Big Nationwide Thank You. It was positioned as a one-off “thank you” payment (and widely discussed because it applied to a large number of members).

Who qualifies for the £50 Big Nationwide Thank You payment?

The biggest gotcha is that eligibility wasn’t for everyone. It depended on membership timing and meeting at least one qualifying condition across accounts, balances, or borrowing (with a separate route for some switchers).

Eligibility checklist

| Requirement | What counts in practice |

|---|---|

| Membership timing | You needed to be a member by the scheme cutoff date and still be a member when the payment was made. |

| Activity option | At least one qualifying transaction during the qualifying period (examples include card payments, cash deposits/withdrawals, Direct Debits, standing orders, Faster Payments, and certain transfers). |

| Balance option | Holding at least £100 across one or more eligible Nationwide current/savings accounts (including relevant ISA balances) at the end of any day in the qualifying period. |

| Mortgage option | Owing at least £100 on an eligible Nationwide residential mortgage at any point in the qualifying period. |

| Switch shortcut | Some customers who completed a qualifying Current Account Switch within the stated window could qualify without meeting the usual activity/balance tests. |

| Joint accounts | Eligibility is assessed per person, but joint product activity/balances can still be relevant to each holder. |

Do business customers qualify?

This is where SME readers often need clarity: it depends on how the account is held (individual vs incorporated entity).

From a compliance and record-keeping perspective, the treatment of these payments depends heavily on business structure. This is where understanding What is an SME becomes relevant, particularly when distinguishing between sole trader arrangements and incorporated entities.

Business account eligibility (sole trader vs company)

| Account holder type | Can it qualify? | What to know |

|---|---|---|

| Sole trader | Potentially | A sole trader’s business savings relationship may count like an individual member relationship in the scheme rules. |

| Partnership (not LLP) | Potentially | Often treated as one qualifying relationship, commonly one payment only for the partnership. |

| Club / unincorporated association | Potentially | Commonly treated as an eligible unincorporated body, usually one payment only. |

| Limited company / LLP | Typically excluded | Incorporated bodies are generally treated differently from individual “members” for these member-payment schemes. |

SME bookkeeping example: If the £50 landed in a business-linked account you use for trading, you’d typically record it as other income (not sales) and keep a statement screenshot/PDF for your records.

If you’re unsure how it should be handled for your structure (especially partnerships), check with your accountant.

When was the £50 paid in April and where should you look?

If you qualified, the payment was typically credited into an eligible Nationwide account (with a priority order across account types). If a credit couldn’t be made, a cheque was issued.

Payment method (where it appears)

| If you had | How you likely received it | Where to check |

|---|---|---|

| Eligible current account | Credited directly | Current account statement around April 2025 |

| Eligible savings accounts | Credited directly (depending on priority order) | Savings statement(s) around April 2025 |

| Mortgage relationship | Could be linked via the account used for mortgage Direct Debits | The DD-paying account statement |

| Payment couldn’t be credited | Cheque posted to your recorded address | Post + cheque deposit history |

What should you do if you think you were eligible but didn’t get it?

Here’s what you can do next (keep it simple first):

- Check all Nationwide accounts you hold (including “quiet” savings accounts) for the payment reference/label around April 2025.

- If you received a cheque, deposit it promptly and keep a copy/photo for your records.

- If you’ve moved address or closed accounts, consider whether your details still match the scheme conditions at the time payments were made.

Is the £50 payment taxable in the UK?

These member thank you payments are often treated similarly to interest for UK tax purposes in many everyday cases, but the right treatment can vary depending on your setup (especially for sole traders, partnerships, and unincorporated bodies).

Tip: If you’re filing a Self Assessment, record it cleanly and keep the statement line as evidence.

How to spot fake £50 Nationwide messages?

Scammers love a free money headline. The safest assumption is: you didn’t apply; eligibility was assessed automatically.

Here’s what you can do next: treat any “claim now” link, request for PIN/password, or pressure message as suspicious and verify through Nationwide’s official app or official contact routes.

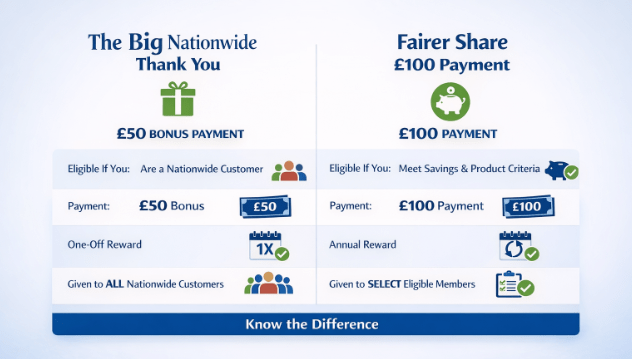

How this differs from Nationwide’s Fairer Share £100 payment?

They’re different schemes with different rules and timing. Don’t assume that qualifying for one means you qualify for the other.

How do people talk about this online?

Just received a £50 payment from my bank simply because they purchased another bank. Apparently free money really does exist.

byu/Ribbitor123 inBritishSuccess

Nationwide pays out another £100 on its fairer share!

byu/frenchbread07 inUKPersonalFinance

Nationwide hands out £50 ‘thank you’ to 12 million savers and borrowers

byu/bvimo inunitedkingdom

Final summary

The phrase nationwide customers to get 50 bonus payment in april refers to a specific Nationwide member payment scheme (a one-off £50 credit/cheque for eligible members). Eligibility depended on membership timing plus account activity/balance/mortgage criteria (with a separate route for some switchers).

Next step: If you think you qualified, check every Nationwide account you hold around April 2025 and confirm whether a cheque was issued.

FAQ

Is Nationwide giving customers a £50 bonus in April?

Yes, it referred to a one-off member payment scheme and was not a generic “apply-now” promotion.

How do I check if I got it?

Check Nationwide account statements around April 2025 for the payment label/reference.

I’m a sole trader, could I qualify?

Potentially, depending on how your account is held and whether you met the qualifying conditions.

Will I pay tax on it?

It may be treated similarly to interest in many cases, but business/partnership setups can be nuanced; record it clearly and check with your accountant if unsure.

Author expertise note (EEAT)

This guide is written in a practical, SME-friendly way based on reviewing Nationwide’s publicly stated scheme rules and typical UK personal finance/tax handling patterns. For edge cases (partnerships, mixed personal/business use, or complex tax positions), your accountant is the best source of tailored advice.