What Is Working Capital? Meaning, Formula & Cycle (2026 UK)

What Is Working Capital? A Practical UK Guide to Working Capital Meaning, Formula, Cycle, Net Working Capital and Working Capital Loans

If you’ve ever asked what is working capital, you’re not alone. In plain English, working capital is the short-term “fuel” that helps your business keep moving, paying suppliers, covering wages, and bridging the gap until customers pay you.

In this guide, you’ll get the working capital meaning, a clear working capital definition, the working capital formula, how net working capital works (including the net working capital formula), how the working capital cycle impacts cash, and when working capital loans make sense.

Let’s explore

- Why you can be profitable but still feel “cash tight”?

- How to calculate working capital from your balance sheet?

- What positive vs negative working capital can indicate?

- How to shorten your working capital cycle?

- How working capital loans can (and can’t) help?

What is working capital and why does it matter in the UK?

Working capital matters because UK businesses often deal with timing gaps—supplier terms, customer payment delays, seasonal stock, and VAT/PAYE/NIC payment dates. Working capital helps you stay steady during those gaps.

Working capital meaning

The working capital meaning is simple: it’s the money (or near-money resources) available to fund day-to-day operations.

It’s especially relevant when: You pay out before you get paid in. That single timing issue is why working capital can make or break otherwise healthy businesses.

Working capital definition

A practical working capital definition is: your short-term financial cushion—how easily you can cover what you owe soon using what you own soon.

Current assets typically include cash at the bank, trade receivables (unpaid invoices), inventory/stock, and certain prepayments.

Current liabilities typically include trade payables (supplier bills), VAT owed, PAYE/NIC due, accruals, and short-term repayments due within ~12 months.

Working capital formula

The standard working capital formula is: Working Capital = Current Assets − Current Liabilities

Here’s a simple UK-style worked example:

| Item | Amount (£) |

|---|---|

| Cash in bank | 12,000 |

| Trade receivables (invoices owed to you) | 30,000 |

| Inventory/stock | 18,000 |

| Total current assets | 60,000 |

| Trade payables (supplier bills) | 22,000 |

| VAT/PAYE and other short-term liabilities | 8,000 |

| Total current liabilities | 30,000 |

| Working capital (assets − liabilities) | 30,000 |

Interpretation: £30,000 of working capital suggests you should be able to cover near-term obligations with near-term resources. But remember: if most of it is stuck in unpaid invoices or slow stock, you can still feel stretched.

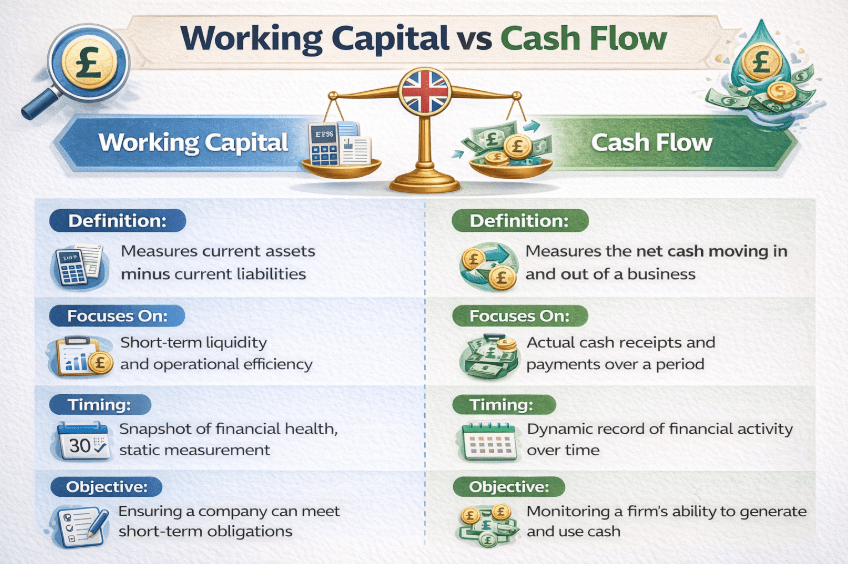

Working capital vs cash flow

Working capital is a balance sheet snapshot. Cash flow is the movement of cash over time. You can have positive working capital and still have cash-flow stress if customers pay late or stock doesn’t shift.

Net working capital

Net working capital is often used interchangeably with working capital in everyday SME conversations.

Understanding the fundamentals of working capital is especially important when managing a small or medium-sized enterprise. See What Is an SME in the UK? to explore how these businesses are defined and why they face unique cash flow challenges.

In some finance/valuation contexts, people may say “operating net working capital” and exclude cash and interest-bearing debt to focus on operations (receivables, inventory, payables).

The key is consistency: track the same definition each month so trends are meaningful.

Net working capital formula

The common net working capital formula is: Net Working Capital = Current Assets − Current Liabilities.

If you’re using an “operating” version, it’s usually a variation that focuses on operating current assets and operating current liabilities (for example: receivables + inventory − payables).

Working capital cycle

The working capital cycle is about timing, how long cash is tied up before it returns to your bank account.

| Stage | What happens? | Practical levers |

|---|---|---|

| Stock/delivery | Cash becomes stock or delivery cost | Buy smarter, reduce dead stock, improve forecasting |

| Invoicing | Work becomes an invoice | Invoice faster, avoid billing errors, and confirm PO details |

| Receivables | You wait to get paid | Clear terms, reminders, deposits, and payment links |

| Payables/tax | You pay suppliers and HMRC | Negotiate terms, schedule payments, and plan VAT/PAYE timing |

Micro-CTA: Here’s what you can do next pick one lever (invoicing speed, stock levels, or payment terms) and improve it for 30 days. Then measure the change in working capital and cash pressure.

Working capital loans?

Working capital loans are designed to support day-to-day operations when cash is temporarily tied up due to seasonality, growth spurts, or slow-paying customers.

| Option | Best for | Watch-outs |

|---|---|---|

| Overdraft | Short-term gaps + flexibility | Limits can change; costs add up if “permanent” |

| Invoice finance | Unlocking cash from unpaid invoices | Fees vary; depends on debtor quality and process |

| Short-term loan | Defined cash need (e.g., stock build) | Repayments must match your cash cycle |

| Revolving credit | Ongoing swings in working capital | Requires discipline to avoid long-term dependency |

Rule of thumb: if the spend won’t help generate cash back within the repayment window, it’s usually not a great fit for working capital borrowing.

How can you improve working capital without borrowing?

You can often improve working capital by tightening credit control (invoice promptly, follow up consistently), reducing cash tied up in slow-moving stock, and aligning supplier payment terms with when customers actually pay.

If you sell projects, consider deposits or milestone billing to reduce cash strain.

What are common working capital mistakes you should avoid?

Confusing profit with cash is the big one. Another is overtrading, growing sales faster than your working capital can support. Finally, don’t treat one “perfect” ratio as universal: industries behave differently.

What’s a 10-minute working capital check you can run today?

- Is your working capital rising or falling over the last 3–6 months?

- Are unpaid invoices growing faster than sales?

- Is stock increasing without a clear reason (seasonality, supplier minimums, new lines)?

- Are you paying suppliers before customers pay you?

- Do VAT/PAYE/NIC dates cause predictable dips you can plan around?

- If a major customer paid two weeks late, would you struggle to pay key bills?

Want a UK working capital calculator you can use right now?

Use this calculator to estimate your working capital (current assets minus current liabilities), plus your current and quick ratios. It uses GBP (£) and includes UK-relevant fields like VAT owed and PAYE/NIC due.

UK Working Capital Calculator

Enter your figures (GBP £). Use balance sheet numbers where possible.

Current assets (due within ~12 months)

Current liabilities (due within ~12 months)

Results

Working capital (Current assets − Current liabilities)

£0

Net working capital

£0

Current ratio (Current assets ÷ Current liabilities)

—

Quick ratio (Quick assets ÷ Current liabilities)

—

Educational tool only. For lending, tax, or solvency decisions, consider a qualified accountant/finance adviser.

How do you use this working capital calculator?

Enter your current assets and current liabilities, then review the working capital figure and ratios. If working capital is negative, focus first on collecting receivables faster, reducing slow stock, and aligning supplier terms with customer payment timings.

What does negative working capital mean?

It means your short-term obligations exceed your short-term resources. That can be normal in some business models, but for many SMEs it signals tighter cash timing risk, especially when VAT/PAYE dates or supplier bills hit before customers pay.

How do people talk about working capital online?

Below is a high-level sentiment snapshot (no quoting), plus real public embeds you can use on your post.

What do Reddit users typically discuss?

Common themes include confusion around different formula “versions” (especially whether to include cash), how working capital affects free cash flow, and why working capital can look healthy on paper but still feel illiquid in real life.

Formula for working capital?

posted in r/CFA

Change in Working Capital and Free Cash Flow

posted in r/financialmodelling

What’s the final takeaway on working capital?

Working capital is your short-term operating cushion. The calculation is simple, but the impact is huge because timing (the working capital cycle) can create pressure even when profits look strong.

Here’s what you can do next: run the calculator above using your latest numbers, then choose one improvement lever (collections, stock, or supplier terms) to work on for the next 30 days.

FAQ on What is working capital?

Is working capital the same as cash flow?

No. Working capital is a balance sheet snapshot, while cash flow is a movement over time. You can have positive working capital and still experience cash stress if invoices are late or stock is slow to sell.

Is higher net working capital always better?

Not always. Too high can mean cash is tied up unnecessarily (excess stock or slow collections). Too low can raise the risk of missing payments. The “best” level depends on your industry and payment model.

When do working capital loans make sense?

When you have a short-term need and a clear path to repayment, like seasonal stock builds, bridging invoice delays, or predictable timing gaps. If borrowing is covering a long-term hole, fix the underlying cycle first.

Author expertise note: This guide is written for SME Business Blog readers by an editorial team that regularly covers UK small business finance, cash flow management, and funding options—aimed at being practical for founders and clear for students.